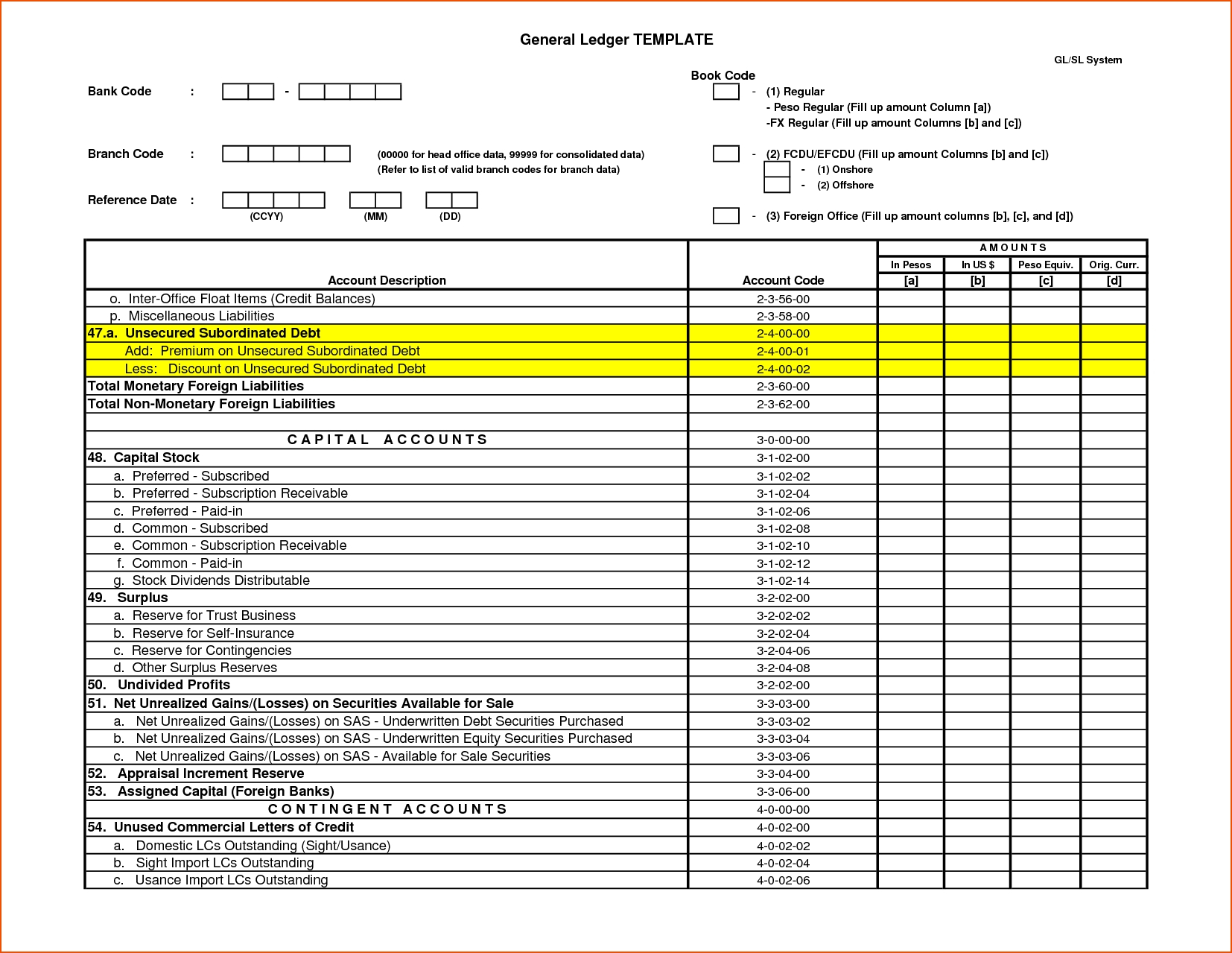

General Ledger Trial Balance Report

Accounts receivable is most commonly used as a general Ledger control account. A purchases ledger helps you to keep a track of the purchases your business makes, so you can make sure that you have enough purchases for the smooth manufacturing of the products. It also details the accounting principles explained: how they work gaap ifrs amount you pay to the creditors as well as the outstanding amount. Besides this, you can refer back to the purchase details in case you need to so in the future. Say you own a publishing house, Martin & Co., and purchased 20kg of paper on cash at $20 per kg on December 1, 2020.

Leverage General Ledger Capabilities Through FreshBooks Accounting Software

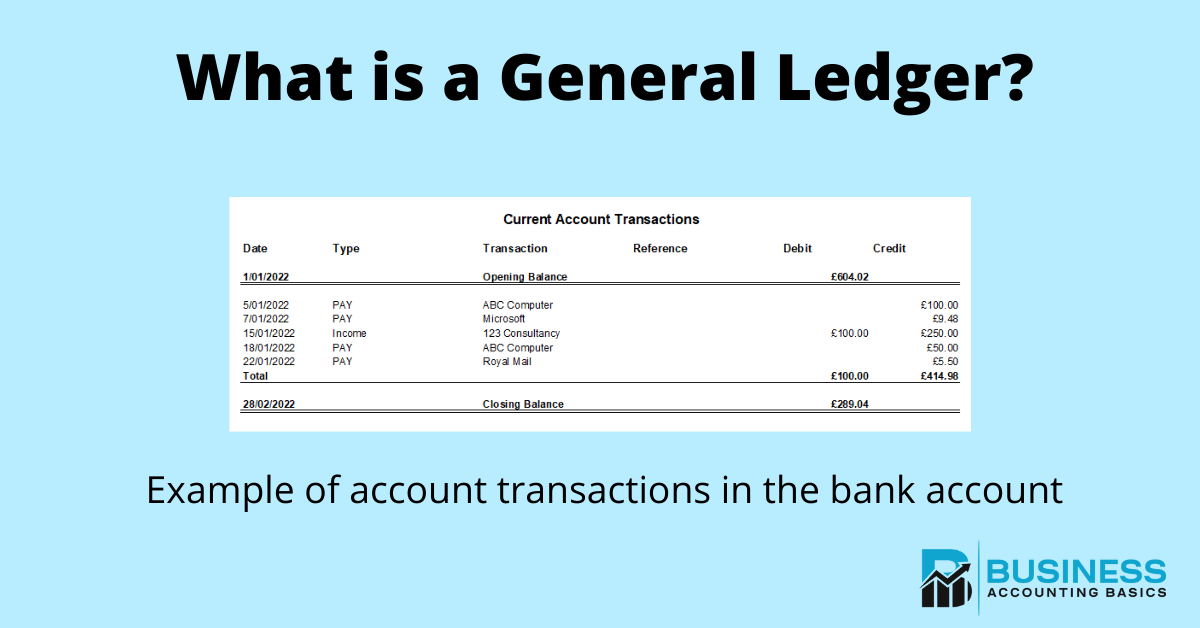

A trial balance is a worksheet with the column of debit and credit corresponding to the rules of double-entry bookkeeping or dual aspect of accounting. To produce all the necessary financial statements, your accountants create the trial balance, which lists each account and the current balance. And to ensure that your financial reports are correct, you can even use an adjusted trial balance to see all your financial transactions in one place. These are what’s used to record your transactions by date, and can include things like payments against invoices and their totals.

Understanding general ledger: Your financial foundation

Thereafter, relevant debit or credit amounts will be noted in the account’s ledger. Then, debit and credit values will undergo further calculations to arrive at a final balance of different accounts. In double-entry accounting, every transaction affects at least two accounts, which helps maintain the balance between debits and credits. For instance, if a business purchases $500 worth of inventory, the general ledger would record $500 as a debit in the inventory account and $500 as a credit in the cash account.

What is your current financial priority?

For example, goods purchased with cash will be recorded in the the general journal as a journal entry. The journal entry will debit goods as an asset and credit cash as it will be going out or reducing to purchase the goods. Ledger balancing assists in computing how much assets, liabilities or revenue sources, etc., are left with an organization at the end of an accounting year. Resultantly, there will be a cash account, salary account, payables account, etc.

- This is done by comparing balances that appear on the ledger accounts to those on the original documents, such as bank statements, invoices, credit card statements, purchase receipts, etc.

- This is because you, or an accounting professional, are no longer required to go through the pain of recording the transactions in the journal first before transferring them to the ledger.

- It uses a double-entry bookkeeping system to ensure every transaction is accurately recorded and balanced.

- Equity accounts show details in ownership interest of your business’s shareholders.

Profit loss accounts

You need to check the transaction amounts recorded as part of your general ledger. If you are preparing your general ledger manually, you will have to keep your source documents handy. These sources will help to verify that the amounts recorded in the ledger accounts are accurate.

If you identify errors or misstatements, you can then take the requisite actions to make good the errors. If you are preparing the journal or ledger manually, you or your accountant will need to go through each of the accounts individually. The credit sales figure of $200,000 would go into the accounts receivable control account. Whereas, the sales details of various debtors like Jack & Co., Mayers, and John can be found in the related subsidiary ledger. As a result, each transaction of your business takes place in such a way that this equality between the two sides of the accounting equation is always maintained. That is, at any point in time, the resources or the assets of your business must equate to the claims of owners and outsiders.

Most companies have many of the same general accounts like cash, accounts payable, and retained earnings, but some companies have specialized accounts specific for their operations. For instance, a retailer might have an account for promotional inventory not for sale. Instead, a manufacturer would probably have raw materials inventory, work in process inventory, and finished inventory accounts. It isn’t uncommon for manufacturers to create specific accounts for each custom job done during the year. The general ledger is one of the cornerstones of the double-entry accounting system.

In the standard format of a ledger account, the page is divided into two equal halves. The left-hand side is known as the debit side and the right-hand side is the credit side. The bank statement style lends itself to modern accounting, but for the time being, double entry will be explained by the older traditional method. Business owners, however, don’t just want to know about the effects of individual transactions on financial statements. Journals are used to record transactions chronologically, but journal entries only show the effect of individual transactions. This means that you don’t need to look through bank statements, invoices, or credit statements for a specific transaction when you have the general ledger at your disposal.