Bank Reconciliation Statement: Examples and Formula

Since the Adjusted balance per BANK of $1,719 is equal to Adjusted balance per BOOKS of $1,719, the bank statement of August 31 has been reconciled. In this section we will prepare a June 30 bank reconciliation for Lee Corp using the five steps discussed above. Record in the company’s general ledger the adjustments to the balance per BOOKS. NSF stands for «Non-Sufficient Funds.» An NSF check is a check that a company tries to deposit but the payer’s bank returns it because there aren’t enough funds in the payer’s account.

Advantages of bank reconciliation statements

Maintaining accurate financial records makes it easier to organize your taxes when it comes time to file. Regular bank reconciliation saves you from having to review a full year of financial records—instead, you can quickly consult your reconciliation statements to review any required information. When a customer deposits a check in his account, the bank immediately credits his account with the amount of the check deposited. Sometime such checks are not honored because the person issuing the check does not have sufficient funds in his account. In such situation, bank reverses the entry and reduces the balance of depositor’s account to previous amount. Company A paid $3,750 worth of checks into its bank account and debited its cash book accordingly, but the bank has not yet credited the funds to the depositor’s account.

Final reconciliation of accounts

Voided checks are those that should not have cleared but somehow appear as debits in your bank statement. In these cases, contact your bank to correct these errors and adjust your cash book to reflect the correct balance. Bank Example 2 showed that the bank debits the depositor’s checking account to decrease the checking account balance (since this is part of the bank’s liability Customers’ Deposits). Bank Example 1 showed that the bank credits the depositor’s checking account to increase the depositor’s checking account balance (since this is part of the bank’s liability Customers’ Deposits).

Omission error

- Try FreshBooks for free to streamline your tax preparation and bank reconciliations today.

- Bank reconciliation statements are effective tools for detecting fraud, theft, and loss.

- It’s important to perform a bank reconciliation periodically to identify fraudulent activities or bookkeeping and accounting errors.

- Consider performing this monthly task shortly after your bank statement arrives so you can manage any errors or improper transactions as quickly as possible.

While it cannot entirely erase the potential for data processing errors, using accounting software can reduce the likelihood of errors to help generate more accurate financial statements. Regularly reconciling your bank statements helps businesses detect potential issues with their financial recording system, making it easier to rectify those problems quickly. This can range from one-off errors such as calculation mistakes or double payments to major concerns like theft and fraud.

Bank Reconciliations: Everything You Need to Know

Outstanding checks are those that have been written and recorded in the financial records of the business but have not yet cleared the bank account. This often happens when the checks are written in the last few days of the month. Find all checks that you have issued but have not been presented for payment.

Deposit in Transit

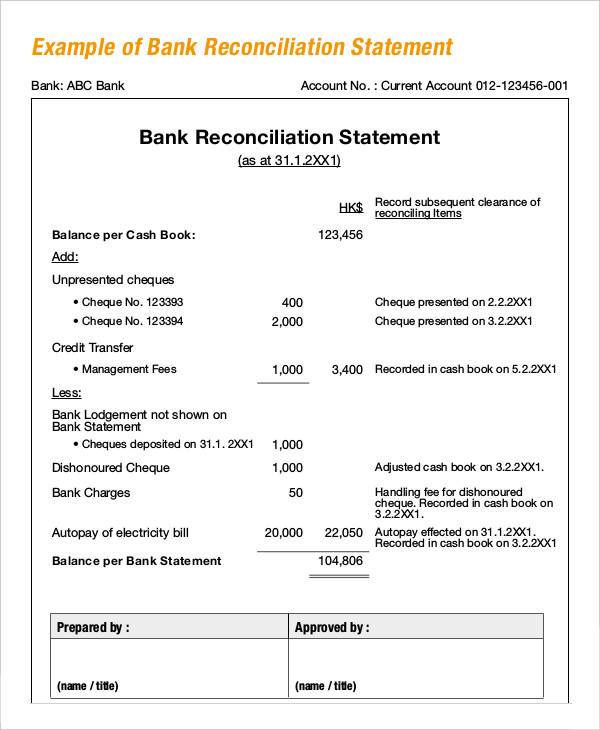

The final step of a bank reconciliation process is to prepare appropriate journal entries for the items that are causing the difference because you have not yet recorded them in your accounting record. A bank reconciliation statement is prepared by a depositor (account holder) to overcome differences in the balances of the cash book and bank statement. Doing bank reconciliations regularly helps companies control their financial transactions and easily track errors and omissions. A bank reconciliation statement should be completed monthly but can even be done weekly if your company processes a large number of transactions. Interest is automatically deposited into a bank account after a certain period of time. So the company’s accountant prepares an entry increasing the cash currently shown in the financial records.

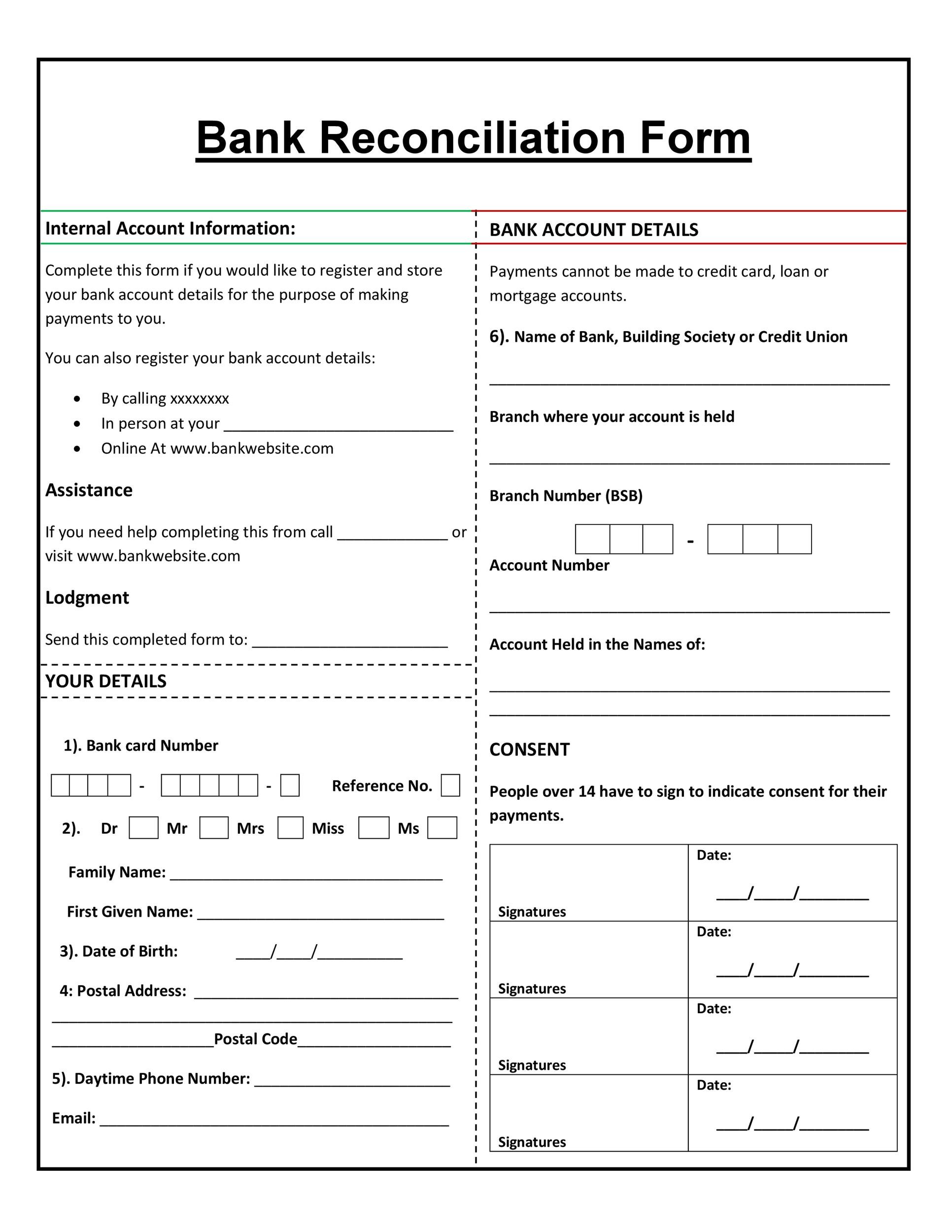

Many banks allow you to opt for fee-free electronic bank statements delivered to your email, but your bank may mail paper bank statements for a fee. A bank reconciliation is a critical tool for managing your cash balance. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account. The reconciliation process also helps you identify fraud and other unauthorized cash transactions.

The bank statement of the Fast Company shows a balance of $10,000 on January 31, 2021 whereas the company’s ledger shows a balance of $8,525. The bank section lists items in transit from the depositor to the bank and bank errors. The book section lists items in transit from the bank, service charges, basic accounting principles and concepts for t and depositor errors. The first step involves identifying any deposits and checks that the bank has not processed at the statement date. The four basic steps involved in the bank reconciliation process are described below. Service charges may be levied by the bank for regular or special services.

As with deposits, take time to compare your personal records to the bank statement to ensure that every withdrawal, big or small, is accounted for on both records. If you’re missing transactions in your personal records, add them and deduct the amount from your balance. If you’re finding withdrawals that aren’t listed on the bank statement, do some investigation.