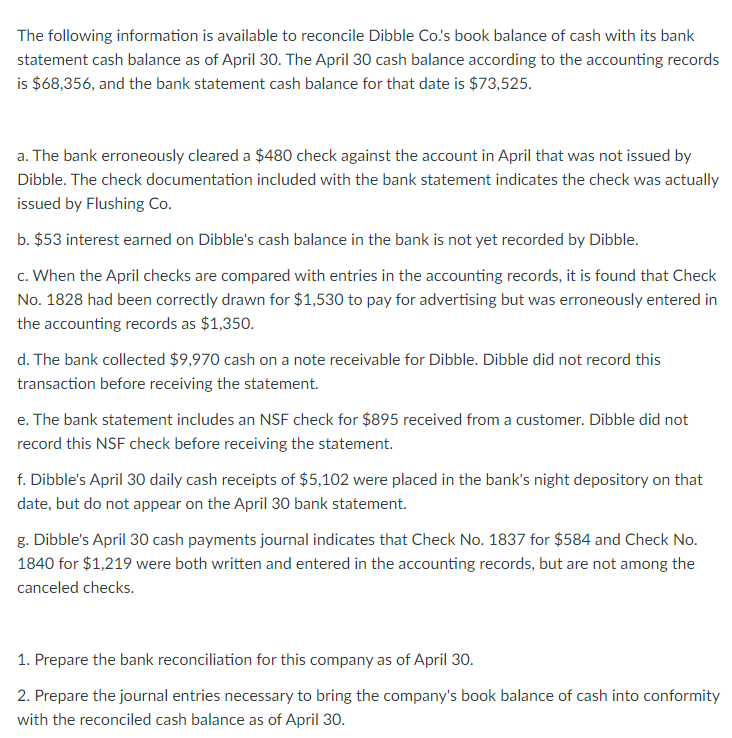

Any time you Choose Financial With Period from forty years?

Bajaj Houses Fund enjoys stretched the brand new period of the financial products for brand new consumers around all in all, forty years. We’re not always enjoying home loans off 40-season period. Until then, the maximum I experienced heard is 3 decades. Therefore, which is a-sharp diving. I don’t need to get into information on mortgage factors out of Bajaj Casing Money. Fund try an item and there is absolutely nothing to differentiate between one one or two financial circumstances.

In this article, I do want to concentrate on the mortgage period of 40 years. Why does a forty-season change the loan EMIs, eligibility, and also the repayment. Why don’t we see.

Higher the borrowed funds Period, Reduce steadily the EMI

We know it. Cannot we? This is loan mathematics. Offered period means a lowered EMI. More affordable. Lower load on your own wallet, but also for a longer title.

- For the 20-season mortgage, you only pay Rs forty two,986 for twenty years. Rs forty two,986 X 20 X twelve = Rs step one.07 crores over twenty years

- For the 40-year mortgage, you pay Rs 38,568 having forty years. Rs 38,568 X 20 X a dozen = Rs step 1.85 crores more forty years.

Note that the real difference is during the affordable repayments. The cost of the mortgage continues to be the same for the funds.

High the mortgage Period, Deeper the borrowed funds Qualifications

On the illustration a lot more than, I’ve thought online month-to-month income regarding Rs fifty,000. And if the banks is more comfortable with Fixed income in order to Financial obligation proportion (FOIR) regarding forty%, this means they’ll be good before the EMI breaches Rs 50,000 X 40% = Rs 20,000.

To possess a great 20-seasons financing, this new violation occurs when the borrowed funds count exceeds Rs lacs. To possess an effective 40- season financing, the latest threshold rises in order to

An excellent 40-Seasons Mortgage Becomes Repaid within a much slower Speed

As you can see, the fresh new stretched our home financing tenure, reduced the speed away from loan prepayment. With a good 40-seasons financing, you’ve repaid fourteen% of one’s dominant immediately following 20 years regarding loan EMIs.

Of a lot borrowers is amazed to understand that the fresh new a good principal count has barely moved even with many years of loan payment. The fresh new amaze will be a whole lot larger to possess an effective 40-year loan. In addition, the banks aren’t fleecing you. Which is how cutting equilibrium mortgage EMIs work.

Higher the borrowed funds Period, Higher Susceptibility to help you Interest rate Actions

Notice the percentage change in EMIs just like the financing period goes right up.The newest stretched tenure loans are affected a lot more. It will help if the interest rates is dropping but could end up being a huge condition in the event that rates of interest go up. We presented the change for just a 1% hike. Think of the horror in case the rates was to increase dramatically in a highly short period.

Just what Should you Manage?

forty years is actually a lifetime. That is more than more individuals might be gainfully doing work in its entire lifetime. That is and the reasons why 40-year lenders are not popular. Whenever i see, Bajaj Housing Finance have a tendency to think most other elements such as your decades and you will works reputation in advance of delegating the maximum mortgage tenure. Not everybody would rating that installment loans online in Louisiane loan period away from 40 years. About how to see away from Bajaj Housing Money.

There aren’t any best otherwise incorrect responses. Nobody wants to get a home loan to possess an extremely much time tenure. Its a profit outgo whatsoever. This is the facts that push your.

I do believe, the main installment (without any prepayments) on the 40-12 months is simply too slow. Hence, it contract will make myself sometime rebellious. Almost just like expenses domestic lease. Keep in mind that house book is really what you pay into household manager and attract is the lease you have to pay on bank. Although not, the great spend lenders is that you can prepay and reduce the latest period of one’s loan aggressively.